CA Filing an Income Expense Declaration free printable template

Show details

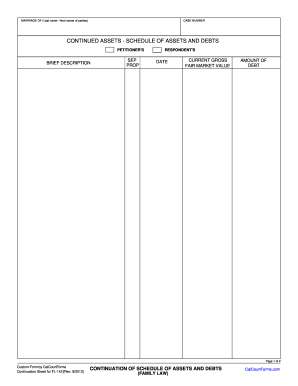

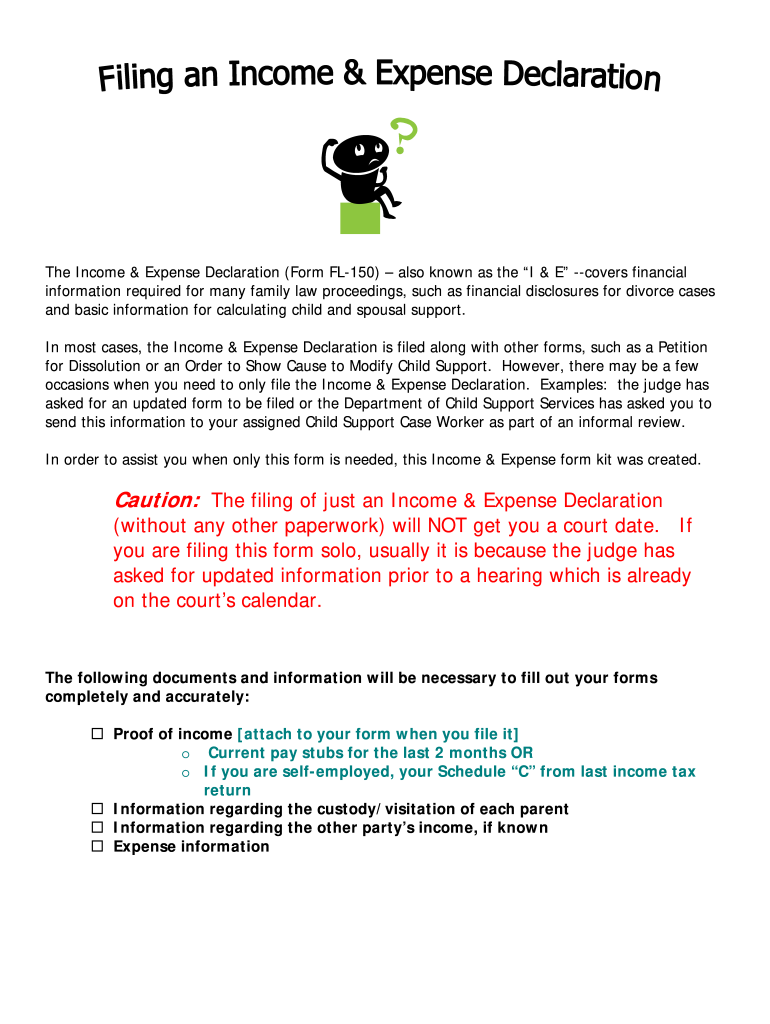

The Income & Expense Declaration (Form FL-150) also known as the & E” --covers financial information required for many family law proceedings, such as financial disclosures for divorce cases and

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign california form fl 150 fillable

Edit your income fl 150 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income and expense declaration form fl 150 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fl 150 online

To use the services of a skilled PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fillable income and expense declaration form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fl 150 income and expense declaration form

How to fill out CA Filing an Income & Expense Declaration

01

Obtain the CA Filing an Income & Expense Declaration form from the relevant court or legal authority.

02

Review the instructions provided with the form to understand what information is required.

03

Gather all relevant financial documents, such as pay stubs, bank statements, and tax returns.

04

Fill out your personal information at the top of the form, including your name, address, and case number.

05

Complete the income section by listing all sources of income, including employment, bonuses, and any other income received.

06

Fill out the expenses section by detailing all monthly expenses such as rent, utilities, groceries, and other living costs.

07

Double-check your entries for accuracy and completeness.

08

Sign and date the form where indicated, declaring that the information provided is true to the best of your knowledge.

09

Submit the completed form to the appropriate court or agency as instructed.

Who needs CA Filing an Income & Expense Declaration?

01

Individuals involved in family law proceedings, such as divorce or custody cases.

02

People applying for assistance or support enforcement through the court system.

03

Parties requesting a modification in child or spousal support arrangements.

04

Anyone required by the court to disclose their financial situation for legal reasons.

Fill

california income fl 150

: Try Risk Free

People Also Ask about delaration fl 150 pdffiller

What is the California Rule of court current income and expense declaration?

California Rules of Court, Rule 5.260(c), states that an Income and Expense Declaration (FL-150) must be submitted with any request to change a prior child support or spousal/domestic partner support order to demonstrate a change of circumstances.

How do I fill out an income and expense form?

0:00 17:44 Below that if you are employed you want to list the name of your employer your employer's addressMoreBelow that if you are employed you want to list the name of your employer your employer's address their phone number your occupation. And the approximate date your job.

How long is income and expense declaration valid California?

First, the Income and Expense Declaration must be current for the past 90 days. Even if an Income and Expense Declaration was filed with a motion to request support, if the hearing occurs over 90 days later, the Income and Expense Declaration is not valid. Therefore, it will require the party to update the document.

How do I fill out income and expense declaration in California?

0:00 17:44 How to Fill Out the Income and Expense Declaration in California YouTube Start of suggested clip End of suggested clip The your last job ended um 1g you want to list if you are employed. How many hours per week you'reMoreThe your last job ended um 1g you want to list if you are employed. How many hours per week you're working on average. And then one h you're going to list your income in a gross.

What is a FL 685?

FL-685 Response To Governmental Notice Of Motion Or Order To Show Cause.

What is a current income and expense declaration California?

California Rules of Court, Rule 5.260(c), states that an Income and Expense Declaration (FL-150) must be submitted with any request to change a prior child support or spousal/domestic partner support order to demonstrate a change of circumstances.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get income and expense declaration?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific income fl 150 pdf and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in filing income fl 150 online without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing income expense fl 150 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I edit income fl 150 blank on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign income and expense declaration fl 150 california. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is CA Filing an Income & Expense Declaration?

CA Filing an Income & Expense Declaration is a legal document that individuals or entities use to report their income and expenses to the appropriate California authority, typically for calculating tax obligations or for eligibility determinations in various programs.

Who is required to file CA Filing an Income & Expense Declaration?

Individuals or businesses that are subject to certain tax regulations or seeking assistance programs in California may be required to file an Income & Expense Declaration, especially if their income levels or financial status are under review.

How to fill out CA Filing an Income & Expense Declaration?

To fill out the CA Filing an Income & Expense Declaration, individuals need to gather accurate financial records, complete the required forms with their income and expenses, ensuring that all figures are correct, and submit the form to the relevant California authority by the specified deadline.

What is the purpose of CA Filing an Income & Expense Declaration?

The purpose of filing a CA Income & Expense Declaration is to provide a transparent account of an individual’s or entity's financial situation, which assists in determining tax liabilities, eligibility for state programs, and compliance with state regulations.

What information must be reported on CA Filing an Income & Expense Declaration?

Required information includes all sources of income, detailed itemization of expenses, any deductions being claimed, and other relevant financial data that reflects the individual's or entity’s overall financial health for the reporting period.

Fill out your CA Filing an Income Expense Declaration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Fill Out Fl 150 California is not the form you're looking for?Search for another form here.

Keywords relevant to california income and expense declaration fl 150

Related to california income fl 150 fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.