Get the free fl 150 form

Show details

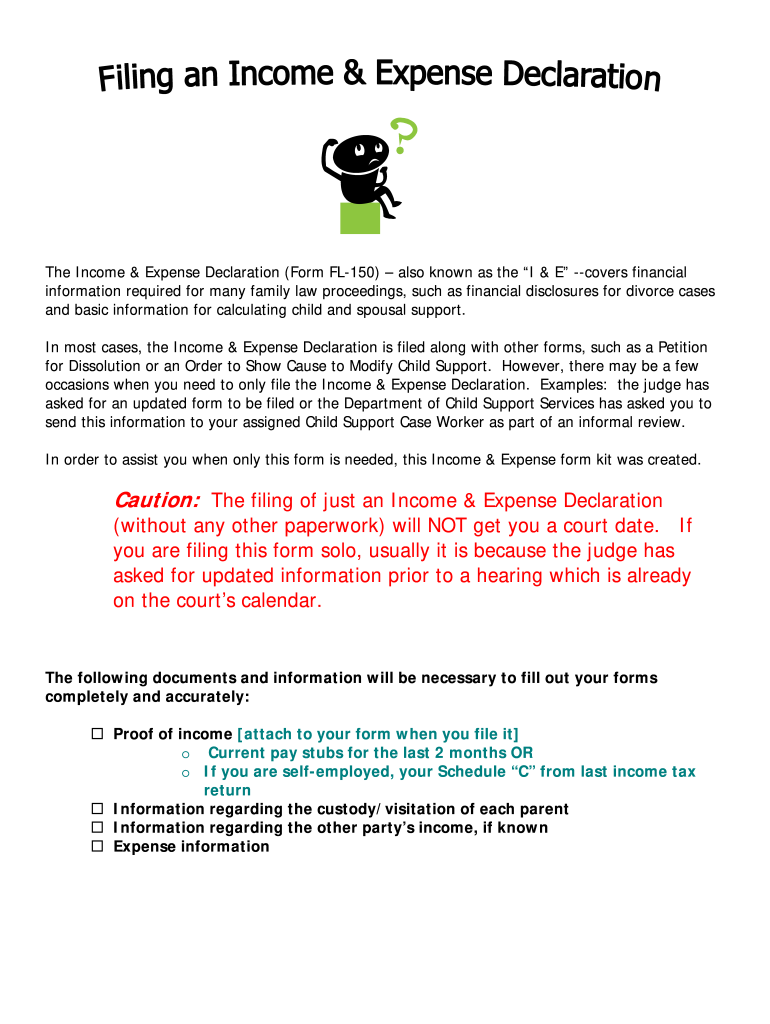

The Income & Expense Declaration (Form FL-150) also known as the & E” --covers financial information required for many family law proceedings, such as financial disclosures for divorce cases and

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your fl 150 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fl 150 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fl 150 online

To use the services of a skilled PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fl150 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out fl 150 form

Point by point, here's how to fill out FL 150:

01

Start by gathering all necessary information and documentation, such as personal details, income statements, asset information, and expense records.

02

Fill out the top section of FL 150, which includes your name, your spouse's name, and the case number. Ensure that all information is accurate and up-to-date.

03

Move on to the income section of FL 150. Provide detailed information about your income, including salary, wages, self-employment earnings, rental income, and any other sources of income. Be sure to accurately report all sources and amounts.

04

Next, complete the expense section of FL 150. List all monthly expenses, such as mortgage or rent payments, utilities, insurance, transportation costs, child support, and any other recurring expenses. It is crucial to be thorough and provide accurate amounts.

05

If you have any debts, such as credit card balances, loans, or medical bills, include them in the debt section of FL 150. Clearly state the amounts owed, the creditor's name, and the monthly payments.

06

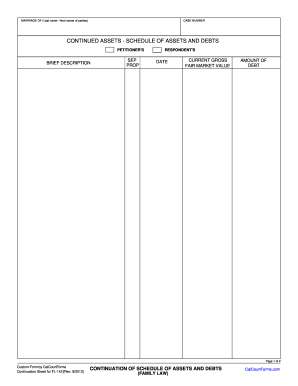

In the assets section of FL 150, list all your owned properties, bank accounts, retirement accounts, vehicles, and other valuable possessions. Provide accurate values and ownership details.

07

If you have any other relevant information or special circumstances that should be considered, include them in the additional comments section of FL 150. This is your opportunity to explain any unique financial situations that may impact the court's decision.

08

Review your completed FL 150 form for any errors or missing information. Double-check that all figures are accurate and all sections have been addressed.

09

Sign and date the FL 150 form to declare that the information provided is true and accurate to the best of your knowledge.

10

Finally, make copies of the completed FL 150 form and any supporting documents before submitting them to the appropriate court or legal professional involved in your case.

As for who needs FL 150, anyone involved in a divorce or legal separation case that requires a disclosure of income and expenses would commonly use this form. This generally includes both parties, as the FL 150 helps provide a comprehensive picture of each individual's financial situation for the court's consideration.

Fill income fl 150 : Try Risk Free

People Also Ask about fl 150

What is the California Rule of court current income and expense declaration?

How do I fill out an income and expense form?

How long is income and expense declaration valid California?

How do I fill out income and expense declaration in California?

What is a FL 685?

What is a current income and expense declaration California?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fl 150?

FL 150 is an aviation term that stands for Flight Level 150. It is the altitude that an aircraft is flying at when the altitude is 15,000 feet above sea level.

What information must be reported on fl 150?

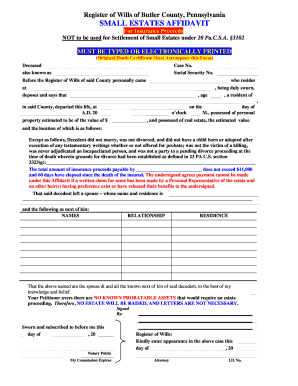

An FL-150 form requires a person to provide the following information: name, address, phone number, case number, court division, current marital status, date of marriage, date of separation, date of filing of the petition, date of birth, and names and birthdates of any minor children.

When is the deadline to file fl 150 in 2023?

The deadline to file FL 150 in 2023 is April 15, 2023.

Who is required to file fl 150?

The FL-150 is a California court form used in divorce cases to disclose a party's income and expenses. It is typically required to be filed by both parties involved in the divorce proceedings.

How to fill out fl 150?

FL-150 is a California form used for the declaration of income and expenses in family law cases. To fill out the form, follow these steps:

1. Download Form FL-150: Visit the California Courts website or search online for "California Form FL-150" to find a PDF version of the form. Download and save it to your computer.

2. Enter case information: At the top of the form, provide your name, your ex-spouse's name, the county name where your case is filed, the case number, and the name of the judicial officer handling your case.

3. Fill out personal information: Include your full legal name, contact information, and attorney's information (if applicable). Provide similar details for your ex-spouse in the corresponding sections.

4. Complete the income section: On Part 2 of the form, list all sources of income for both you and your ex-spouse. This includes wages, self-employment income, government benefits, rental income, pensions, and any other sources. You will need to provide specific details like the amount, frequency (e.g., weekly, monthly), and source.

5. Add income deductions: Deductions reduce your gross income. Common deductions include state and federal taxes, mandatory retirement contributions, union dues, and health insurance premiums. Deduct these amounts from your gross income and note the remaining net income.

6. Report monthly expenses: In Part 3, list your monthly expenses in the appropriate categories provided on the form. Include details for items such as rent/mortgage, utilities, transportation, insurance, child care, medical costs, and debts. Be thorough and accurate.

7. Calculate monthly surplus or deficit: Subtract your total monthly expenses from your net income to determine if you have a surplus (positive number) or a deficit (negative number). Write the total in the appropriate space provided.

8. Complete the property section: Provide details about your properties, vehicles, bank accounts, and other assets separately in Part 4 for both you and your ex-spouse. Include fair market values, loan amounts, and monthly payments.

9. Review and sign: Before submitting the form, carefully review all the information you have entered, ensuring accuracy and completeness. Sign and date the form at the bottom.

10. Serve and file the form: Make copies for yourself, your attorney (if applicable), and your ex-spouse. File the original form with the court clerk, and serve a copy to your ex-spouse as required by the court rules.

Remember, it is essential to consult with an attorney or a family law facilitator if you have any doubts or questions while completing Form FL-150 to ensure accuracy and compliance with court procedures.

What is the purpose of fl 150?

FL-150 is a form used in the legal system of California, specifically in family law cases. The purpose of FL-150, also known as the Income and Expense Declaration, is to disclose the financial information of both parties involved in a family law matter, such as divorce, child support, or spousal support cases. This form allows the court to assess the parties' incomes, expenses, assets, and debts, which helps in determining appropriate support orders, property division, or other financial matters related to the case.

What is the penalty for the late filing of fl 150?

I'm not a legal expert, but in general, the penalty for the late filing of FL-150 (Financial Statement) may vary depending on the jurisdiction and specific circumstances. Failing to file the FL-150 on time can disrupt the court proceedings and may have consequences for your case, potentially leading to penalties, fines, or adverse rulings. It is advisable to consult with a family law attorney or a legal professional in your jurisdiction for accurate and specific information regarding penalties associated with late filing of FL-150.

How can I get fl 150?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific fl150 form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in fl 150 form without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing income expense fl 150 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I edit filing fl 150 instructions on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign income expense fl150 form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your fl 150 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fl 150 Form is not the form you're looking for?Search for another form here.

Keywords relevant to fl 150 fillable form

Related to fl 150 pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.